SWIFT vs local payment routes – Why your best international payment route isn’t what you’d expect.

Thanks to the phenomenon of globalisation, we’re becoming one big, beautiful, interconnected world. We continue to gather momentum to create smarter ways of moving forward together.

What underpins the success of globalization? There’s the connectivity of WiFi, accessibility to unique goods, the ability to create relationships with total strangers based on common interests — and the ability to facilitate international exchange by making payments across the globe. In order to make the most of our increasingly globalized and connected world, we’ll need to understand what options are available to us for moving money across borders and which best fits our needs.

Economically, hundreds of millions of businesses are now dependent on navigating through the international payments maze that is international payments or risk losing customers to those that do. Between sending fees, receiving fees, exchange rates and corresponding bank charges, it leaves one to wonder: “Did I take the right route?”

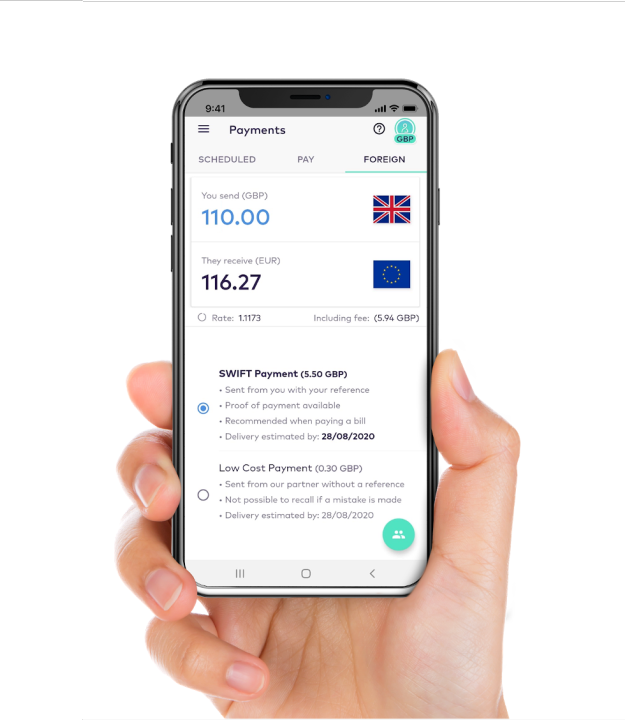

You may have two options depending on your priorities. For many growing businesses, cost-savings and cash flow are absolutely essential. Others may be dependent on traceability and transparency for those big ticket transactions.

Get to know your options, starting with SWIFT payments.

What is a swift payment?

Safely delivering our payments since the 1970s, SWIFT (or the Society for Worldwide Interbank Financial Telecommunications) is the most popular global messaging system used by banks and financial institutions to manage cross-border transactions.

SWIFT is as an all-in-one provider, offering every currency you’d ever need. Best of all, SWIFT-based payments can be received by everyone everywhere.

SWIFT gpi (gpi stands for global payment innovation) burst onto the scene in the last few years, it’s now the most transparent payment route. In essence, SWIFT global payment innovation provides members visibility into the enitre payment journey and continuous tracking throughout. Using SWIFT gpi, unique tracking codes provide you with insight into where your payment is, what fees it has accrued and more. What’s more, SWIFT is gpi enabled. The gpi initiative has been adopted by organisations across the globe to make sending and receiving money across borders as straightforward as possible.

The platform keeps accruing new features, too; the SWIFT organization recently announced a roadmap for planned updates to be released by November 2022. These include upfront validation of beneficiary details, an extension of SWIFT’s gpi rails to lower-value payments, new rich data services based on international standards and more.

However, the cost of great features is literal: SWIFT comes at a premium. There are three types of SWIFT transfer: BEN, OUR and SHA. Each of these choices will determine who incurs the charges.

- BEN: Your recipient incurs all fees, and the payment arrives short

- OUR: You — as the payer — accept all charges (typically billed separately), and the payment arrives in full

- SHA: Each party is charged by their respective bank, with the payer billed separately by the sending bank and the recipient paying for fees from the receiving bank out of their payment.

You’ll notice that all of these methods incur fees — sometimes significant ones. Minimizing these fees is a big part of the reason why businesses look into local payment routes.

Local payment routes: The game changer

Local payment routes are the newest kid on the block. With growing availability and a cost-effective approach emphasizing speed to market, this tech-friendly option has evolved dramatically in recent years. On the rise with no signs of slowing down, it’s evolving with the times.

Examples of local payment schemes include ACH (Automated Clearing House) in North America, SEPA (Single Euro Payments Area) in Europe and Faster Payments in the UK. These are scheme-based transfers that allow you to pay as if you were based domestically — or in other words, you can settle multiple currencies locally without cross-border fees.

It should be noted that under local routes, received payments will show as originating from the payment company, not yourself. That is, unless you use Currencycloud to facilitate international payments — we’re working to enable payers to change the sender display information for certain payment routes. In the meantime, most corporate payments are linked to invoice numbers or similar identifiers that are most commonly used for reconciliation, and these can be added to the payment reference.

You’re probably wondering why local routes aren’t all the rage, seeing as they’re fee-free. There are a few reasons:

- First of all, they’re still an emerging service. You may struggle to find an established local scheme outside of more common, mature financial markets.

- Second, they’re feature-poor. Most local routes are not particularly transparent or automated — though that is changing quickly.

- Third, they can be tough to connect to at scale without the right approach.

Instant local routes: The end game

Today, many local routes offer an instant option that mitigates many of the drawbacks of local payments. For one, they’re literally instant. Automated processes ensure that you’ll never lose a payment. Many countries are moving towards this system as it’s faster and more secure than other cross-border payment options.

The drawback to instant local routes? Both sending and receiving systems must be connected to the scheme. But if both parties are connected to, say, the SEPA scheme, an instant local route like SEPA Instant could be a very attractive method for making cross-border payments.

Getting your plan in action and selecting the right provider

In the financial world, everything is increasingly interconnected. There are over 70 local schemes and 18 instant payment rails across the globe, which means there’s more available liquidity than ever before. You have control over your cross-border transactions with your choice of SWIFT gpi vs Local payment routes or both.

The only limiting factor? Selecting a financial services provider that meets all of your needs.

The core issue with payment routes: they’re notoriously frustrating to tap into. For instance, a surprising number of banks in Europe are not enabled to accept or send SEPA Instant. Your current provider may have SWIFT but not gpi or local schemes; or, they might be equipped to handle SWIFT and local schemes but not gpi. This can be a large drawback for your business, given the benefits that come with the likes of a gpi initiative.

That’s why businesses are best off selecting a provider with a large partnership network, which will increase the options available to you as your business continues to grow. At Currencycloud, we empower the champions that support your cross-border payment services by providing the infrastructure necessary for international transactions. When you work with a Currencycloud customer to facilitate your cross-border payments, you gain the benefit of our existing network of partnerships.

Today, Currencycloud supports 38 currencies, enabling you to send payments in 33 currencies via SWIFT and 21 currencies via local routes. We’re already connected to 21 local systems via pre-established banking partnerships, giving you instant access to SEPA, ACH, Faster Payments and more.

Whether you already know which payment route is best for your business or are still evaluating, connect with me and we can discuss solutions. Thinking about and facilitating cross-border payments is what we do at Currencycloud, so we’re well-equipped to talk over your concerns no matter where you are in your payments journey.

Or, if you’re curious about which of our partners can best support your cross-border transactions, visit our partnership page to learn more about who we work with and how they can help your business grow at an international scale.

Talk to one of our payment experts to discuss which method is best for your business SWIFT vs Local payment routes.